Borrow from Retirement With A 401k Loan: A Comprehensive Guide

Navigating 401k Loans: Balancing Today’s Needs with Tomorrow’s Retirement

In times of financial stress, the idea of borrowing from your 401k can seem like an immediate solution. However, this decision can have significant long-term effects on your retirement savings. The challenge lies in addressing your current financial needs without compromising your future financial stability.

While a 401k loan might provide the quick financial relief you need, it’s crucial to consider how it could set back your retirement plans. It’s a balance between fulfilling immediate financial obligations and preserving your nest egg for the future.

This guide is designed to simplify the process of borrowing from your 401k. We’ll help you understand the loan terms, evaluate its impact on your retirement, and guide you through making a well-informed decision.

Understanding 401k Loans: The Essentials

A 401k loan allows you to access funds from your retirement account, subject to certain rules. Here’s a brief overview:

- Borrowing Limits: You’re generally allowed to borrow up to 50% of your vested account balance, up to $50,000.

- Repayment Terms: Repayment typically spans up to five years, often requiring regular quarterly payments.

- Interest: The interest paid on the loan is credited back into your 401k account.

Grasping these fundamental aspects is key in evaluating whether a 401k loan aligns with your financial strategy, especially considering its impact on your long-term retirement planning.

Understanding the Financials: 401k Loan Interest and Payments

Borrowing from your 401k involves more than just accessing your funds; it’s crucial to understand the financial implications, particularly the interest rates and repayment process. This section breaks down these key aspects, helping you to navigate the cost considerations of a 401k loan.

Interest Rates on 401k Loans

The interest rate for a 401k loan typically follows the plan’s guidelines, generally based on the prime rate with an additional percentage. Unique to this loan type, the interest paid goes back into your 401k account, effectively letting you ‘pay yourself back’ with interest.

Calculating Loan Payments

Using a 401k loan calculator can provide a clear understanding of your repayment obligations. It takes into account the loan amount, interest rate, and repayment term, offering insights into your monthly payments and the total amount you’ll end up paying back. This tool is essential for assessing the loan’s impact on both your immediate finances and your long-term retirement savings.

Exploring the Reasons: Why Borrow from Your 401k?

Deciding to take a loan from your 401k shouldn’t be made lightly. Understanding the various reasons people choose to borrow from their retirement savings can help you evaluate if it’s the right decision for your circumstances.

People opt for 401k loans for a variety of reasons, each with its own set of considerations:

- Home Purchase: Many use 401k loans for significant expenses like buying a home, taking advantage of not having to qualify for a bank loan or deal with potential credit issues.

- Debt Consolidation: Some find 401k loans useful for consolidating high-interest debt, potentially leading to lower overall interest payments.

- Emergency Expenses: Unexpected costs, such as medical bills or urgent home repairs, can lead individuals to tap into their 401k.

- Education Costs: Funding education, whether for themselves or family members, is another common reason for a 401k loan.

While these reasons are valid, it’s crucial to balance the immediate need for funds with the potential long-term impact on your retirement savings. A 401k loan might solve a current financial problem, but it could also diminish your future financial security. Understanding why you need the loan and considering all possible alternatives is key to making a sound financial decision.

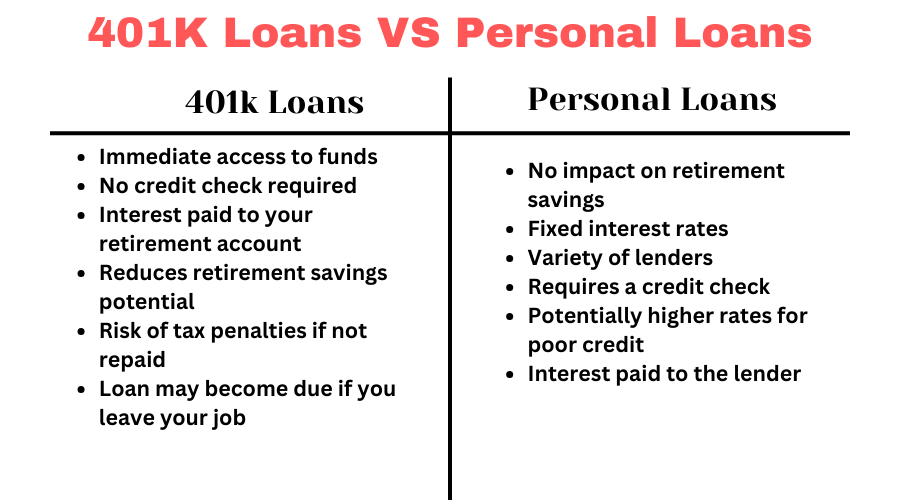

Financial Crossroads: 401k Loans vs. Personal Loans

When considering a loan, it’s important to compare 401k loans with personal loans, as each has its own set of benefits and drawbacks. This section helps you understand these differences to make an informed choice based on your financial situation.

When choosing between a 401k loan and a personal loan, consider factors like the impact on your retirement savings, interest rates, and how your employment status might affect your ability to repay a 401k loan. Your decision should align with both your immediate financial needs and your long-term financial health.

The Payback Plan: Navigating 401k Loan Repayment

Understanding the repayment process of a 401k loan is essential for managing your finances effectively. Here’s what you need to know about paying back a 401k loan:

- Repayment Timeline: Generally, 401k loans must be repaid within five years. However, if the loan is used for a home purchase, this period might be extended.

- Payment Frequency: Repayments are usually required to be made at least quarterly, but many plans ask for monthly payments.

- Direct from Paycheck: Repayments are often deducted directly from your paycheck, making the process convenient and ensuring timely payments.

- Interest Repayment: The interest you pay on the loan is credited back into your 401k account. It’s like paying the interest to yourself, which can help offset some of the impacts of borrowing from your retirement funds.

By staying informed about the repayment process, you can ensure that your 401k loan doesn’t become a financial burden. Remember, timely repayment is crucial to avoid taxes and penalties and to keep your retirement savings on track.

Exploring Financial Alternatives to 401k Loans

When considering different financial solutions, it’s beneficial to examine a range of options beyond 401k loans. Each alternative offers distinct advantages and risks:

Immediate Financial Solutions:

- Payday Loans: Offer immediate cash but usually with high costs.

- Personal Loans: Ideal for those with good credit, offering lower interest rates and requiring proof of repayment ability.

- Credit Card Cash Advances: Easily accessible, yet tend to have high interest rates and fees.

- Title Loans: Quick cash using your vehicle as collateral, but risk losing the vehicle.

- Peer-to-Peer Loans: Flexible, community-based lending with varying rates.

- Home Equity Loans: Based on home equity, offering lower rates but carrying the risk of foreclosure and requiring a longer approval process.

- HELOC (Home Equity Line of Credit): Offers adaptable access to funds through variable interest rates, making it perfect for recurring expenses.

- Pawn Shop Loans: Provide quick access to cash with valuables as collateral, but come with the risk of losing your items.

- Getting a New Credit Card: Useful for short-term expenses with 0% introductory offers, but consider the standard rate post-introductory period.

BadCreditLoans.com | Quick Loans up to $10,000

»

|

Brigit | Build Your Credit and Your Savings

»

|

iCash Loans | Get a Loan Today

»

|

Wells Fargo Reflect® | 0% APR for 21months (Credit Score 670+)

»

|

Income Strategies Without Debt:

- Borrowing from Family and Friends: Can offer low- or no-interest loans but may affect personal relationships.

- Selling Personal Items: A way to raise funds without incurring debt, though it may take time.

- Seeking Community Assistance: Non-repayable support from charities or government programs for those in financial distress.

- Exploring Side Gigs: Part-time work or freelancing to earn extra income without taking on loans.

Each alternative has its advantages and drawbacks. Carefully consider factors like interest rates, repayment terms, and the potential impact on your financial health to make a decision that suits your immediate needs and long-term financial goals.

Weighing the Scales: The Benefits and Drawbacks of 401k Loans

When it comes to taking out a 401k loan, understanding both its advantages and disadvantages is crucial for making an informed decision. Here we delve into an in-depth analysis of the pros and cons.

Pros:

- Quick access to funds without a credit check.

- Simple application process.

- Interest paid into your own 401k account.

- No impact on credit score.

Cons:

- Can reduce future retirement savings.

- Full repayment often required if you leave your job.

- Missed investment growth on borrowed funds.

- Potential taxes and penalties for non-repayment.

When considering a 401k loan, balance these factors against your current financial needs and long-term retirement goals. It’s crucial to ensure you can manage repayment without adversely affecting your future financial health.

Addressing Common 401k Loan Queries: Your Questions Answered

Navigating the details of a 401k loan involves addressing some key questions that borrowers commonly have. Here’s a closer look at these inquiries.

Will my employer know if I take a 401k loan?

Your employer will typically be aware of a 401k loan since these loans are part of the retirement plan they manage. However, this information is usually just a part of standard plan administration and doesn’t generally impact your job.

How long does it take for a 401k loan to be approved?

The approval time for a 401k loan can vary, often ranging from a few days to a couple of weeks. This depends on the specific procedures and rules of your 401k plan.

How can I borrow from my 401k without penalty?

To avoid penalties when borrowing from your 401k, it’s crucial to adhere to the repayment terms. Typically, you need to repay the loan within five years to steer clear of any penalties.

How many months do I have to pay back a 401k loan?

You’re usually required to repay a 401k loan within 60 months or five years. Some plans might offer extended repayment terms, particularly for loans used for home purchases.

What happens if I pay off my 401k loan early?

Paying off a 401k loan early generally doesn’t result in penalties. In fact, early repayment can be a smart move to minimize interest accumulation and to replenish your retirement savings sooner.

These answers aim to provide clarity on some of the most common concerns regarding 401k loans. Remember, specific details can vary by plan, so consulting with your plan administrator for personalized information is always a good idea.

Conclusion: Navigating Your Decision on 401k Loans

As we reach the end of our guide on 401k loans, the key takeaway is the importance of balancing immediate financial needs with long-term retirement planning. While 401k loans can provide quick access to funds, the potential impact on your future savings and investment growth is a critical consideration. It’s essential to approach this decision with a comprehensive understanding of both the benefits and risks involved.

Reflect on your current financial situation, the urgency of your needs, and your ability to repay the loan without jeopardizing your retirement goals. Remember, the right financial decision is one that not only addresses your immediate challenges but also aligns with your overall financial well-being.

Take the Next Step with Confidence

Are you considering a 401k loan, seeking further guidance, or exploring other financial options? A financial advisor is ready to assist. Reach out for customized advice that aligns with your unique situation. They can offer the insights and support necessary to make a well-informed choice.

Furthermore, if you possess valuable experiences or insights regarding 401k loans, sharing them could greatly benefit others in similar situations. Partner with a financial advisor to pave the way toward financial stability. Contact a financial advisor today.

Looking for Emergency Funding? Know Your Options

- HELOC Loans Unlocked: How Do They Work?

- Borrow from Retirement With A 401k Loan: A Comprehensive Guide

- Title Loans Explored: Your Guide to Borrowing Against Your Car

- Mastering Credit Cards: Types, Benefits, and Strategic Use

- Credit Card Cash Advances: Emergency Funds When You Need Them Most

- Home Equity Loans Explained: Unlocking Your Home’s Financial Power

- Pawn Shop Loans Unlocked: Your Ultimate Guide to Quick Cash and Smart Borrowing

- Peer-to-Peer Lending for Bad Credit: Unlocking Financial Opportunities

- Drive Away Happy: Your Complete Guide to Auto Loans and Buying a Car

- Unlock Your Dream Home: A Stress-Free Guide to Understanding Mortgages